Q2 2022: Macro Investor Trends with Co-founder and Principal, Sean Mabarak

The most difficult period for forecasting since SPI's inception

Today we are faced with a disorienting mix of global market sentiment hovering near all-time lows and the strongest performance trends at the property level we’ve ever seen. I was the first to be skeptical of how sustainable the impressive occupancy and rental income trends that started in late 2020 would be. It felt like an overcorrection at the time; a reversion to the mean after pausing rent increases during pandemic lockdowns. Yet here we are nearly two years later, and those trends not only persist but their breadth has widened to include nearly every asset class and geographic region in which we operate. All of this is in stark contrast to financial markets unraveling in the face of a hawkish Fed that has committed to using every tool at its disposal to try to tame inflation.

Since multifamily debt markets tend to follow financial markets, we’ve seen an abrupt deterioration in debt terms and the number of lenders actively originating loans. In Q4’21 and Q1’22 we were attaining 60-70% Loan-to-Value (LTV) at sub-3% interest rates. Today these terms are closer to 45-60% LTV at 5%+ interest rates. These are obviously drastic moves that directly affect return on investment.

So, how does this affect market pricing? Should values go down proportionately with available leverage? How does rental income growing 5x faster than the historical average factor in? What if market consensus is that multifamily lending rates will return to 3-4% within the next two years? Should we all just go on vacation until the Fed cuts rates again?

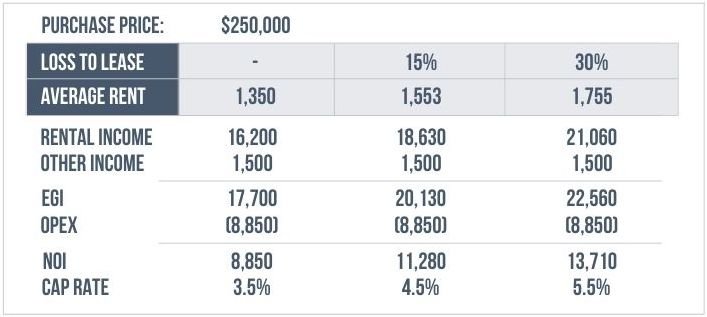

As discussed in our prior newsletter, the sustained rental rate growth creates a situation where even the most prudent investors can comfortably pull forward proven income growth and underwrite considerably higher income than the trailing twelve months or even annualized T3 data. The example below shows how a 3.5% cap rate can quickly become a 4.5% cap rate once you burn off that 15% loss to lease (the difference between recent leases and average in-place rent). If recent leases are being signed at 30% above in-place, as is the case at several of our properties, a 3.5% cap rate today is a 5.5% cap rate once loss to lease is burned off.

So, where is the disconnect? Lender underwriting standards do not support this method of forecasting income, and for good reason. Leading up to the Great Financial Crisis, aggressive proforma income assumptions were the norm, whether they had been proven out or not. Now we are in a situation where we have the most robust growth in fundamentals I’ve seen, but no lender will give us credit for it, so there is a hard cap on leverage with traditional agencies, life co, and bank lending.

The minimum yield (annual percentage return on cash invested) required by most investors and institutions now prevents buyers from paying lower cap rates in the face of 5% interest rates. Compared to just months ago when a buyer could borrow at 3% and pay a 3% cap rate knowing they had 15-30% effective rent growth baked in. To me, this disconnect presents the opportunity to make investments in seemingly bulletproof fundamentals at discounted pricing.

Since the demand for yield is a constant in our industry, there are many investors on the sidelines waiting for price discovery to play out, either by choice or because they are already overexposed to rates rising. However, given the rapid growth in rental income, cap rates will catch up sooner than many may realize, so it makes sense to us to jump on opportunities priced 5-15% below recent sales comps with 15-30% loss to lease to burn off. Then if multifamily lending rates do end up coming back down to the 3-4% range while we capture loss to lease, our returns will be amplified even further through lower debt service, higher free cash flow, and cap rate compression. Until fundamentals at the property level flatline or deteriorate, the current risk-reward of actively investing in new projects is highly skewed towards reward.

As always, we at SPI Advisory will search through countless opportunities both on- and off-market to identify those we feel will provide the best risk-adjusted returns at that moment in time. I am personally excited that there is [finally] a palpable dislocation in the marketplace presently, as this should uncover opportunities we can capitalize on. The Texas multifamily market has been long overdue for the sobering shock capital markets have delivered this year. SPI will continue to use sensible leverage as a tool and not a crutch so that in times of uncertainty our primary focus can be uncovering opportunities in the chaos rather than scrambling to identify insolvency risk in current holdings, as I imagine some are doing presently.

Cheers,